Posted On January 03, 2020

What do you mean by credit and how are credit scores calculated?

Whenever you want to borrow money, open a utility account or rent an apartment, you're asking the other person to trust in your ability to pay your bills within the specified time period. But lenders and landlords aren’t going to call up each one of your credit card issuers since the sophomore year and ask whether you're good with returning money on time. What they do is that they pull up your credit score.

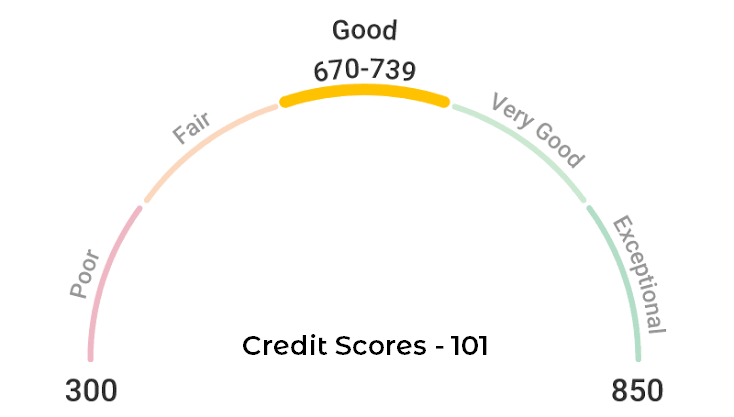

If your entire financial life from birth since present could be boiled down to one number, it would be your credit score. It's a three-digit number that represents your history of borrowing and paying back money. The higher your credit score, the more trustworthy you're considered to be by creditors. Now how is this credit score calculated? There are three major credit bureaus in Canada which are Transunion, Equifax and Dun & Bradstreet. The first two deal with consumers while dun & Bradstreet is the most popular credit reporting agency for businesses. So, what these credit bureau reporting agencies do is that they collect all your personal and financial information and put in into a credit report. Credit reports have details of personal information such as your name, address and Social Security number, as well as open and closed credit card accounts, bills in collections, loans and bankruptcies. You're entitled to get a free credit report from each of the three major bureaus every year through AnnualCreditReport.com which is the only site federally authorized to provide free credit reports.

Using the information found in your credit reports, credit bureaus will calculate a credit score that is then shared with banks, lenders and other organizations. And due to the fact that there are multiple credit bureaus, you have more than one credit report and credit score.

Why do you need a good credit score?

The society is becoming more and more dependent on credit purchases, specially the younger generation who do not have sums of money stacked but still wish to buy things and use services that are out of their budget so what they do is use credit cards. Here are few of the many important aspects describing why you need a good credit score.

Credit affects your mortgage loans sanctioning and interest rates– when you are out to buy a house the mortgage lender will consider checking your credit score so that he knows if you’re capable enough of paying back the debt on time. A person with a bad credit score is considered as risky for lending a mortgage loan to. Now if the loan is sanctioned, the interest rate will depend on the credit as well. A high credit will ensure you low interest rates and vice versa

Automotive loans require good credit - most people do not have the funds to buy a vehicle and cover living expenses at the same time. So, they apply for auto loans, your credit rating determines whether you’ll get a loan, of how much amount and at what interest rate.

Credit checks for employment purposes - Many employers in the market conduct credit checks as part of the hiring process. (Note that employers check credit reports, not credit scores.) If you haven’t demonstrated financial responsibility in the past, a proposed employer might be hesitant to hire you.

Basic living expenses also require good credit - It might be shocking to learn that your credit is needed to authorize basic utility services like cable, telephone, water and even cell phone service. Electric companies argue that if you’re borrowing one month of electric service you should have good credit. Most utility services conduct credit checks.